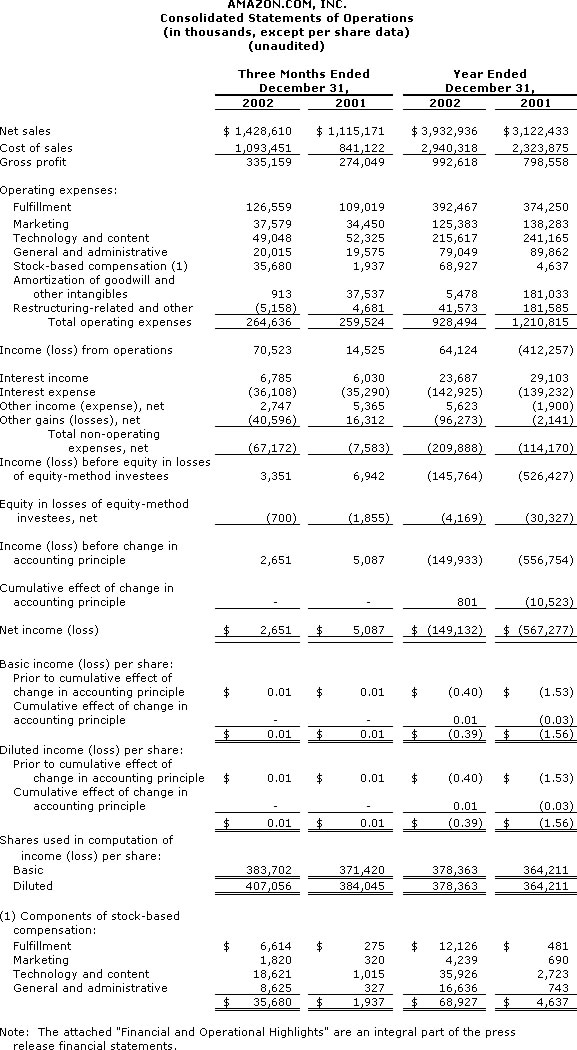

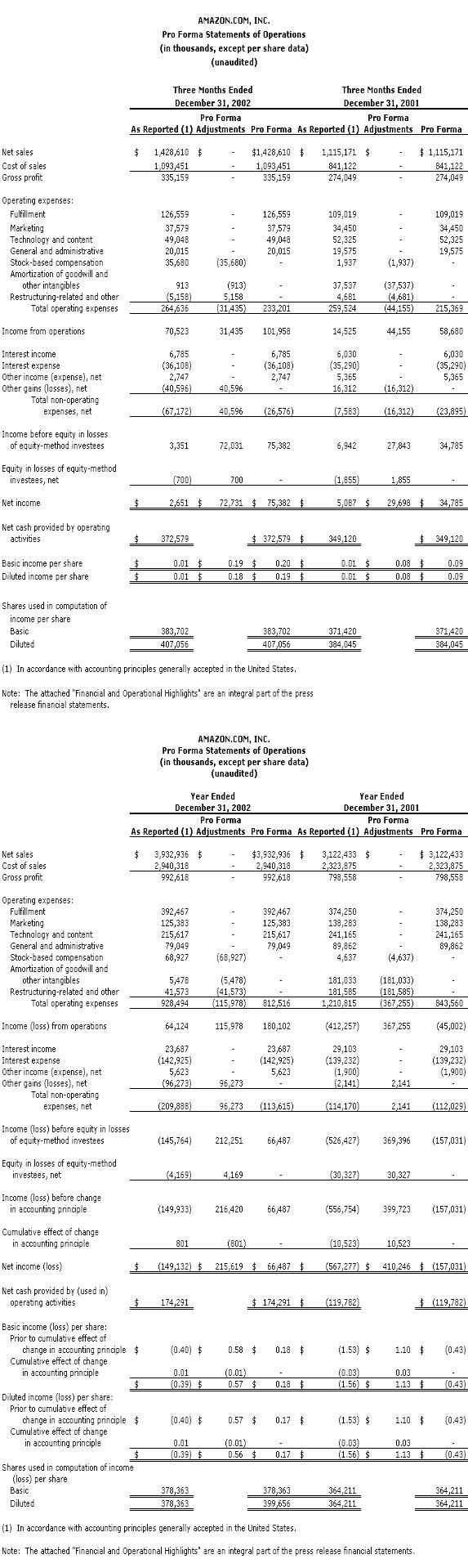

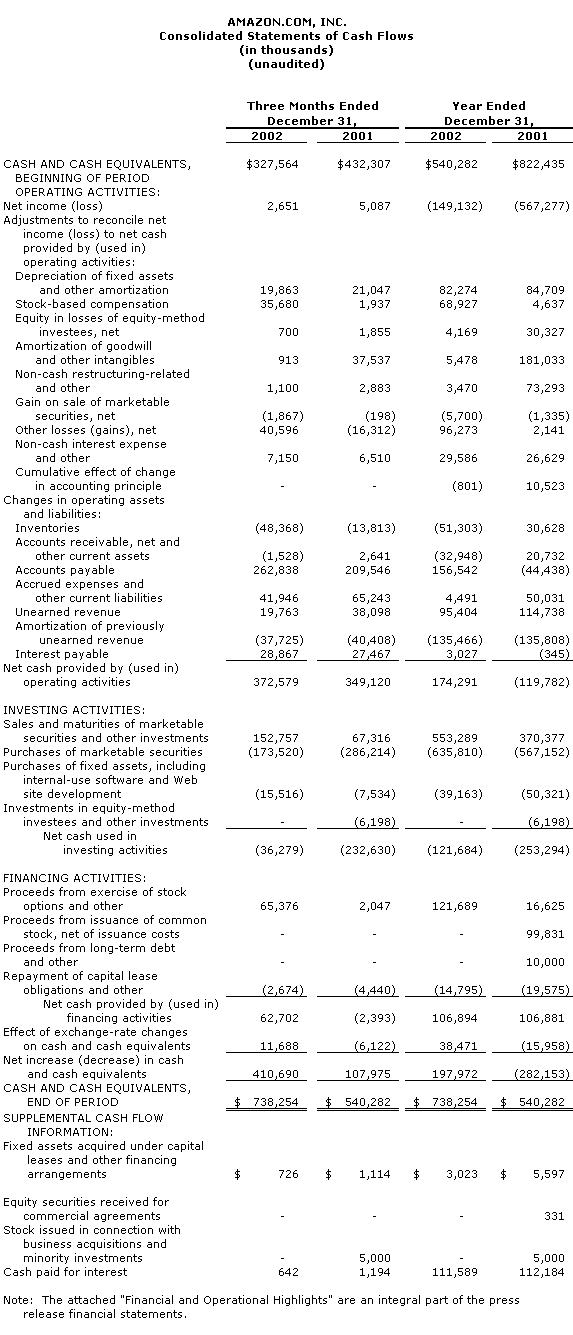

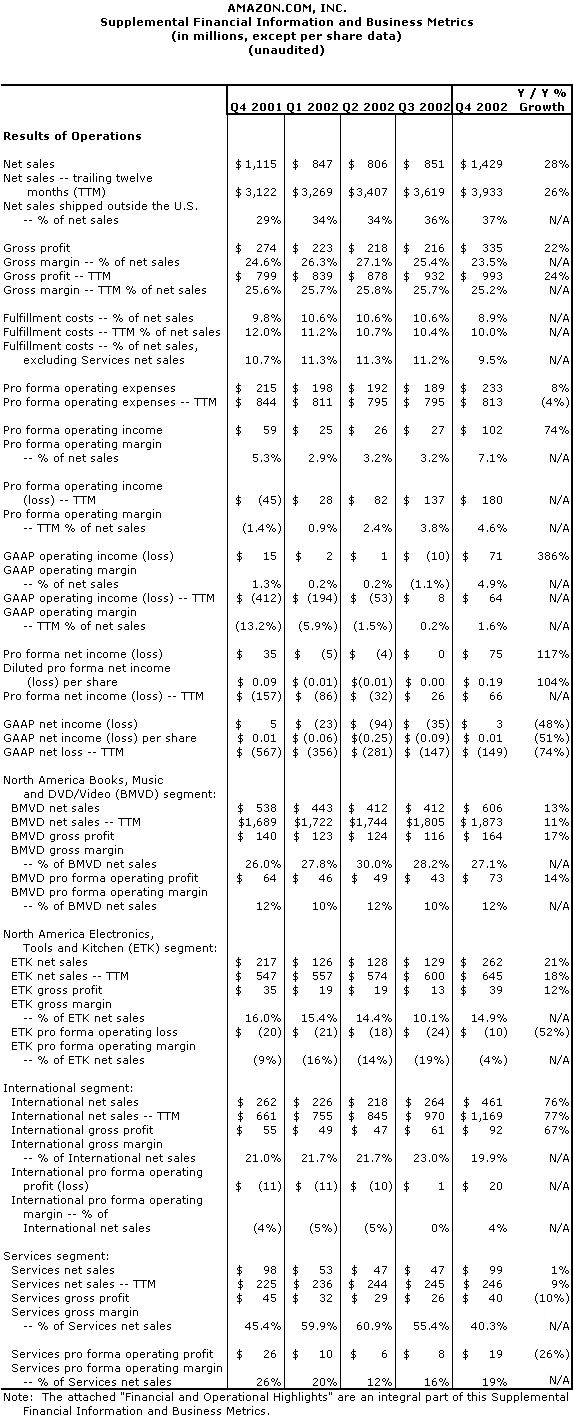

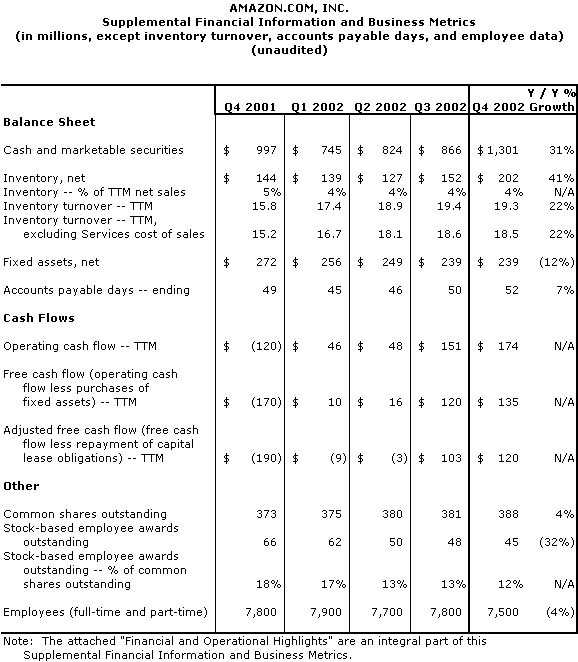

AMAZON.COM ANNOUNCES 28% SALES GROWTH FUELED BY LOWER PRICES; FREE SUPER SAVER SHIPPING ON ORDERS OVER $25 TO CONTINUE YEAR-ROUND SEATTLE--(BUSINESS WIRE)--January 23, 2003--Amazon.com, Inc. (NASD: AMZN), today announced financial results for its fourth quarter and fiscal year ended December 31, 2002. Free cash flow was $135 million for fiscal 2002, compared with negative $170 million for 2001. Free cash flow includes cash outflows for interest and capital expenditures and excludes proceeds from the exercise of stock-based employee awards. Common shares outstanding plus shares underlying stock-based employee awards totaled 433 million at December 31, 2002, a decrease of 1% compared with a year ago. Net sales were a record $1.429 billion in the fourth quarter, compared with $1.115 billion in the fourth quarter 2001, an increase of 28%. Net sales grew 26% to a record $3.933 billion for fiscal 2002, compared with $3.122 billion for 2001. Operating income was $71 million in the fourth quarter, or 5% of net sales, compared with $15 million in the fourth quarter 2001. Operating income for fiscal 2002 improved to $64 million, or 2% of net sales, compared with a 2001 operating loss of $412 million. Pro forma operating profit in the fourth quarter grew 74% to $102 million, or 7% of net sales, compared with a fourth quarter 2001 pro forma operating profit of $59 million. Pro forma operating profit for fiscal 2002 was $180 million, or 5% of net sales, an improvement of $225 million compared with 2001. Net income was $3 million, or $0.01 per share, in the fourth quarter, compared with $5 million in the fourth quarter 2001, or $0.01 per share. Net loss for fiscal 2002 was $149 million, or $0.39 per share, compared with $567 million, or $1.56 per share, in 2001. Pro forma net profit in the fourth quarter, which includes interest expense, grew over $40 million to $75 million, or $0.19 per share, compared with $35 million, or $0.09 per share, in the fourth quarter 2001. Pro forma net profit for fiscal 2002 improved over $223 million to $66 million, or $0.17 per share, compared with a 2001 pro forma net loss of $157 million, or $0.43 per share. (Details on the differences between GAAP results and pro forma results are included below, with a tabular reconciliation of those differences included in the attached financial statements.) "On top of the five price cuts we've made over the past 18 months, we're announcing today that we've decided to make Free Super Saver Shipping on orders over $25 a full-time, year-round offer," said Jeff Bezos, Amazon.com founder and CEO. "We're at a tipping point. Customers are now shopping at Amazon.com as much for our lower prices as for our selection and convenience." In addition to its year-round Free Super Saver Shipping on orders over $25 at www.amazon.com, the Company offers free shipping options at its U.K., German, French, Japanese and Canadian sites. Amazon.com also offers 30% off books over $15 and significantly lowered prices on electronics, tools, and bestselling CDs and DVDs. "Our continued operational progress and momentum allow us to offer year-round free shipping and at the same time increase our 2003 guidance," said Tom Szkutak, chief financial officer of Amazon.com. "Our 2003 objective is to continue improving productivity and lowering prices for customers." Highlights of Fourth Quarter and Fiscal 2002 Results (comparisons are with the equivalent period of 2001)

- Worldwide unit growth was 34% for 2002.

- Third-party seller transactions (new, used and refurbished items sold on Amazon.com product detail pages by businesses and individuals) grew to 21% of worldwide units in the fourth quarter, compared with 16% of units a year ago.

- Inventory turns improved 22% to 19 for 2002, up from 16.

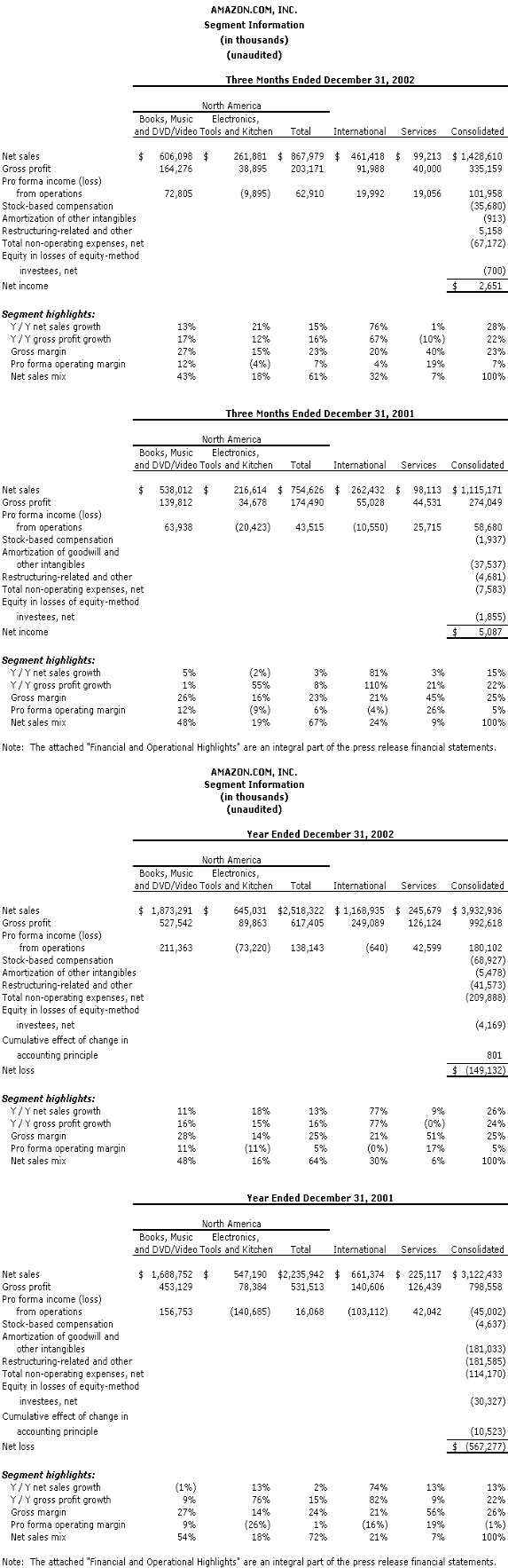

- Books, Music and DVD/Video segment sales grew 13% to $606 million in the fourth quarter and pro forma operating profit grew 14% to $73 million.

- Electronics, Tools and Kitchen segment sales grew 21% to $262 million in the fourth quarter and pro forma operating loss declined 52% to $10 million.

- International segment sales, representing the Company's U.K., German, French and Japanese sites, grew 76% to $461 million in the fourth quarter and exceeded $1 billion for the first time with sales of $1.169 billion in 2002. Pro forma operating profit was $20 million in the fourth quarter, or 4% of net sales, and approached breakeven for 2002.

- Apparel and Accessories, with more than 450 brands and one shopping cart, is the Company's fastest-growing store in terms of units sold in the first 60 days since it opened in November.

Financial Guidance and 2003 Expectations The following forward-looking statements reflect Amazon.com's expectations as of January 23, 2003. Results may be materially affected by many factors, such as changes in global economic conditions and consumer spending, fluctuations in foreign-currency rates, the emerging nature and rate of growth of the Internet and online commerce, and the various factors detailed below.

First Quarter 2003 Guidance- First quarter net sales are expected to be between $1.025 billion and $1.075 billion, or grow between 21% and 27%

- First quarter pro forma net profit is expected to be between $5 million and $20 million, or between $0.01 per share and $0.05 per share.

Full Year 2003 Expectations- Net sales are expected to grow over 15%.

- Pro forma net profit is expected to be over $115 million, or over $0.27 per share.

A conference call will be Webcast live today at 2 p.m. PT/5 p.m. ET and will be available through March 31, 2003, at www.amazon.com/ir. This call will contain forward-looking statements and other material information. These forward-looking statements are inherently difficult to predict. Actual results could differ materially for a variety of reasons, including, among others, the rate of growth of the economy in general and of the Internet and online commerce; customer spending patterns; the amount that Amazon.com invests in new business opportunities and the timing of those investments; the mix of products sold to customers; the mix of net sales derived from products as compared with services; competition; risks of inventory management; the degree to which the Company enters into, maintains and develops service relationships with third-party sellers and other strategic transactions; foreign-currency exchange risks; seasonality; international growth and expansion; risks of fulfillment throughput and productivity; and fluctuations in the value of securities and non-cash payments Amazon.com receives in connection with such transactions. Other risks and uncertainties include, among others, risk of future losses, significant amount of indebtedness, potential fluctuations in operating results, management of potential growth, system interruptions, consumer trends, fulfillment center optimization, inventory, limited operating history, government regulation and taxation, customer or third-party sellers fraud, Amazon.com Payments, and new business areas, business combinations and strategic alliances. More information about factors that potentially could affect Amazon.com's financial results is included in Amazon.com's filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2001, and all subsequent filings. Pro Forma Results Pro forma results, which generally exclude non-operational, non-cash expenses and income as well as one-time charges, are provided as a complement to results provided in accordance with accounting principles generally accepted in the United States (known as "GAAP"). Management uses such pro forma measures internally to evaluate the Company's performance and manage its operations. A reconciliation of GAAP to pro forma is included in the attached financial statements. Pro forma operating profit (loss) excludes the following line items on the Company's statements of operations:

- Stock-based compensation,

- Amortization of goodwill and other intangibles, and

- Restructuring-related and other.

Pro forma net profit (loss) excludes, in addition to the line items described above, the following line items on the Company's statements of operations:

- Other gains (losses), net,

- Equity in losses of equity-method investees, net, and

- Cumulative effect of change in accounting principle.

About Amazon.com Amazon.com, a Fortune 500 company based in Seattle, opened its virtual doors on the World Wide Web in July 1995 and today offers Earth's Biggest Selection. Amazon.com seeks to be the world's most customer-centric company, where customers can find and discover anything they might want to buy online at a great price. Amazon.com and sellers list millions of unique new and used items in categories such as apparel and accessories, electronics, computers, kitchen and housewares, books, music, DVDs, videos, cameras and photo items, office products, toys, baby items and baby registry, software, computer and video games, cell phones and service, tools and hardware, travel services, magazine subscriptions and outdoor living items. Through Amazon Marketplace, zShops and Auctions, any business or individual can sell virtually anything to Amazon.com's millions of customers. Amazon.com operates six global Web sites: www.amazon.com, www.amazon.co.uk, www.amazon.de, www.amazon.fr, www.amazon.co.jp and www.amazon.ca.

Contact:

Amazon.com Investor Relations Amazon.com Public Relations

Tim Halladay, 206/266-2171, Bill Curry, 206/266-7180

ir@amazon.com

|

AMAZON.COM, INC.

Financial and Operational Highlights

(unaudited) Results of Operations (all comparisons are with the equivalent period of the prior year)

Net Sales

- Net sales benefited from changes in foreign-currency exchange rates compared with the prior year by approximately $35 million in the fourth quarter 2002 ($3 million benefit to pro forma operating profit) and $47 million for fiscal 2002 ($4 million benefit to pro forma operating profit).

- Shipping revenue, which excludes commissions earned from Amazon Marketplace, was approximately $121 million in the fourth quarter, down from $125 million.

Gross Profit

- Shipping costs increased 11% to $151 million in the fourth quarter 2002 and shipping loss increased to approximately $30 million, from a loss of $11 million. We continue to measure our shipping results relative to their effect on our overall financial results, with the viewpoint that shipping promotions are an effective marketing tool. We expect to continue offering our customers free shipping options, which reduce shipping revenue as a percentage of sales and negatively affect gross margins.

Fulfillment

- Fulfillment costs represent those costs incurred in operating and staffing our fulfillment and customer service centers, credit card fees and bad debt costs. Fulfillment costs also include amounts paid to third-party cosourcers, who assist us in fulfillment and customer service operations. Certain Services-segment fulfillment-related costs incurred on behalf of third-party sellers are classified as cost of sales rather than fulfillment.

Stock-Based Compensation

Hypothetical Increase

Over $13.375 per Share | Hypothetical Market

Price per Share | Hypothetical Cumulative

Compensation Expense | Hypothetical vs. Cumulative Compensation Expense

December 31, 2002 | | | | | 15% | $15.38 | $47 | $(13) | 25% | $16.72 | $52 | $(8) | 50% | $20.06 | $65 | $4 | 75% | $23.41 | $77 | $17 | 100% | $26.75 | $90 | $29 |

Actual variable-accounting-related compensation could differ significantly from the above illustration in instances where options are exercised during a period at prices that differ from the closing stock price for the reporting period.

- During the first quarter 2001, we offered a limited non-compulsory exchange of employee stock options, which results in variable accounting treatment for approximately 5 million stock options at December 31, 2002, including approximately 4 million options granted under the exchange offer that have an exercise price of $13.375 and expire in the third quarter 2003. Variable accounting treatment will result in unpredictable charges or credits dependent on the fluctuations in quoted prices for our common stock, which we are unable to forecast.

- At December 31, 2002, cumulative compensation expense associated with variable accounting treatment, including $31 million in the fourth quarter 2002, was approximately $60 million--based on exercises to date and a quarter-end closing common stock price of $18.89--of which $40 million is associated with options exercised and no longer subject to future variability.

- We have quantified the hypothetical effect on stock-based compensation associated with various quoted prices of our common stock using a sensitivity analysis for our outstanding stock options subject to variable accounting. We have provided this information to give additional insight into the volatility we will experience in our future results of operations to the extent hat the quoted price for our common stock is above $13.375. This sensitivity analysis is not a prediction of future performance of the quoted prices of our common stock. Using the following hypothetical market prices of our common stock above $13.375 (including the actual expense associated with options exercised), our hypothetical cumulative compensation expense at December 31, 2002, and the difference between hypothetical cumulative compensation expense and actual cumulative compensation expense recorded at December 31, 2002, resulting from variable accounting treatment would have been as follows (in millions, except per share amounts):

- Under our restricted stock unit program, which commenced in the fourth quarter 2002, we award restricted stock units as our primary vehicle for employee equity compensation. Restricted stock units are measured at fair value on the date of grant based on the number of shares granted and the quoted price of our common stock. Such value is recognized as an expense ratably over the corresponding service period. To the extent that restricted stock units are forfeited prior to vesting, the corresponding previously recognized expense is reversed as an offset to stock-based compensation.

Amortization of Goodwill and Other Intangibles - As a result of our adoption of Statement of Financial Accounting Standards No. 141 and No. 142, during the first quarter 2002 we reclassified $25 million of other intangible assets (comprising only assembled workforce intangibles) into goodwill and discontinued the amortization of our goodwill.

Restructuring-Related and Other - In January 2001, we announced and began implementation of our operational restructuring plan to reduce our operating costs, streamline our organizational structure, consolidate certain of our fulfillment and customer service operations and migrate a large portion of our technology infrastructure to a new operating platform. The restructuring plan is complete, although we may adjust our estimates prospectively if necessary.

- Corresponding with our January 2001 operational restructuring, in the fourth quarter 2002 we reached a termination agreement with the landlord of our leased fulfillment center facility in McDonough, Georgia. This agreement requires payments totaling $12 million, $4 million of which was paid in the fourth quarter 2002 ($8 million is payable first quarter 2003). As a result of this agreement, in the fourth quarter 2002 we adjusted our restructuring liability to reflect current estimates of restructuring-related cash flows and recorded a $5 million restructuring-related gain.

- Restructuring-related cash payments totaled $11 million in the fourth quarter 2002 (including the $4 million paid with respect to our McDonough facility), compared with $14 million. We anticipate the following net cash outflows associated with restructuring-related commitments (amounts due within 12 months are included within accrued expenses and other current liabilities and the remaining amounts within long-term debt and other on our balance sheet):

(in millions) | Leases (a) | Other | Total | | | | | | | Year Ending December 31, | | | | | 2003....................................................... | 21 | 4 | 25 | | 2004....................................................... | 12 | 1 | 13 | | 2005....................................................... | 5 | - | 5 | | 2006....................................................... | 3 | - | 3 | | 2007....................................................... | 3 | - | 3 | | Thereafter............................................... | 8 | - | 8 | | Total estimated cash outflows..................... | $52 | $5 | $57 |

(a) Net of anticipated sublease income of approximately $47 million (we have signed contractual sublease agreements covering $10 million in future payments) on gross lease obligations of $99 million.

Other Income (Expense), Net

- Other income, net includes net realized gains on sales of marketable securities.

Other Gains (Losses), Net - Other losses, net primarily consist of a foreign-currency loss on the remeasurement of our 6.875% Euro-denominated convertible subordinated notes (PEACS) from Euros to U.S. dollars. We are unable to accurately forecast the effect on our future reported results associated with the remeasurement of the PEACS.

Income Taxes - At December 31, 2002, we had net operating loss carryforwards (NOLs) of approximately $2.5 billion related to U.S. federal, state and foreign jurisdictions. Utilization of NOLs, which begin to expire at various times starting in 2010, may be subject to certain limitations. Approximately $1.2 billion of our NOLs relate to deductible stock-based compensation in excess of amounts recognized for financial reporting purposes--to the extent any of this amount is realized, the resulting benefit will be credited to stockholders' equity, rather than results of operations.

Net Income - Although we reported fourth quarter 2002 positive net income of $3 million, we believe that this positive net income result should not be viewed as a material positive event and is not predictive of future trends for a variety of reasons. For example, excluding the $5 million restructuring-related gain associated with our McDonough, Georgia, fulfillment center lease-termination agreement, we would have reported a net loss in the fourth quarter 2002. Alternatively, excluding the $31 million stock-based compensation charge associated with variable accounting treatment on certain of our employee stock options that resulted from an increase in our stock price during the fourth quarter, or excluding the $38 million foreign-currency loss on the remeasurement of our PEACS from Euros to U.S. dollars, we would have reported more net income in the fourth quarter 2002.

- We are unable to forecast the effect on our future reported results of certain items, including the stock-based compensation charges or credits associated with variable accounting treatment on certain of our employee stock options that will result from fluctuations in our stock price, and the gain or loss associated with our PEACS that will result from fluctuations in foreign-currency rates.

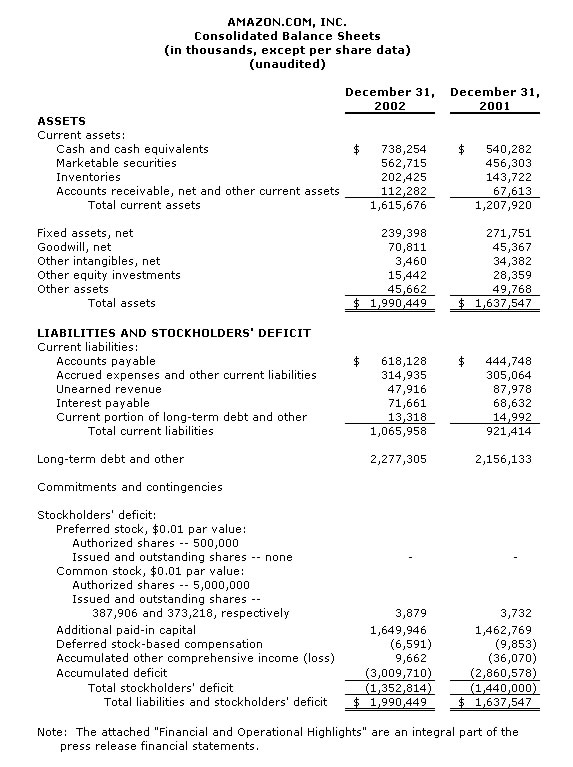

Financial Condition Our marketable securities, at estimated fair value, consist of the following at December 31, 2002 (in millions): Asset-backed and agency securities $317

Treasury notes and bonds 175

Corporate notes and bonds 43

Certificates of deposit 22

Commercial paper, short-term obligations and equity securities 6

$563

- At December 31, 2002, we have pledged approximately $121 million of our marketable securities as collateral for certain contractual obligations, compared with $167 million. Amounts pledged for standby letters of credit that guarantee certain contractual obligations, primarily property leases, were $58 million; $23 million is pledged for a swap agreement that hedges the foreign-exchange-rate risk on a portion of our PEACS; and $40 million is pledged for certain of our real estate lease agreements. The amount of marketable securities we are required to pledge pursuant to the swap agreement fluctuates with the fair market value of the swap obligation.

- Long-term debt primarily includes the following (in millions):

| Principal

at Maturity | Interest

Rate | Principal

Due Date | | | | | | Senior Discount Notes | $ 264(a) | 10.000% | May 2008 | Convertible Subordinated Notes | 1,250 | 4.750% | February 2009 | PEACS | 725(b) | 6.875% | February 2010 | Total Long Term Debt | $ 2,239 | | | | | | | (a) $256 million at December 31, 2002 | | | | (b) 690 million Euros | | | |

Certain Definitions and Other - Our segment reporting includes four segments: North America Books, Music and DVD/Video ("BMVD"); North America Electronics, Tools and Kitchen ("ETK"); International; and Services. Stock-based compensation, amortization of goodwill and other intangibles, and restructuring-related and other costs are not allocated to segment results. All other centrally incurred operating costs are fully allocated to segment results. There are no internal transactions between the Company's reporting segments.

- The BMVD segment includes revenues, direct costs and cost allocations primarily associated with retail sales from www.amazon.com and www.amazon.ca for books, music, DVDs, video products and magazine subscription commissions. This segment also includes revenues from stores offering these products through our Syndicated Stores Program, such as www.borders.com, and commissions and other amounts earned from sales of these products offered by third-party sellers (businesses and individuals) under our Amazon Marketplace (such as a used out-of-print book) and Merchant@amazon.com Programs.

- The ETK segment includes revenues, direct costs and cost allocations primarily associated with www.amazon.com retail sales of electronics, home improvement and home and garden products, as well as our catalog sales of toys and tools. This segment also includes commissions and other amounts earned from sales of these products offered by third-party sellers under our Amazon Marketplace and Merchant@amazon.com Programs.

- The International segment includes all revenues, direct costs and cost allocations associated with the retail sales of our internationally focused U.K., German, French and Japanese Web sites--www.amazon.co.uk, www.amazon.de, www.amazon.fr and www.amazon.co.jp. This segment also includes commissions and other amounts earned from sales of products offered by third-party sellers under our Amazon Marketplace and Merchant@amazon.com Programs and revenues from stores offering products through our Syndicated Stores Program.

- The Services segment includes revenues, direct costs and cost allocations associated with certain of our commercial agreements, including the Merchant Program, such as www.target.com, and the Merchant@amazon.com Program to the extent full product categories are not also offered by our online retail stores, such as Toys and Games and Apparel and Accessories. This segment also includes our technology alliance with America Online and miscellaneous marketing, promotional and other agreements.

- All references to customers mean customer accounts, which are unique e-mail addresses, established either when a customer's initial order is shipped or when a customer orders from certain third-party sellers on our Web sites. Customer accounts include customers of Amazon Marketplace, Auctions and zShops and our Merchant@amazon.com and Syndicated Stores Programs, but exclude Merchant Program customers, Amazon.com Payments customers, our catalog customers and the customers of select companies with whom we have a technology alliance or marketing and promotional relationships. A customer is considered active upon placing an order.

- All references to units mean units sold (net of returns and cancellations) by us and third-party sellers at Amazon.com domains worldwide--such as www.amazon.com, www.amazon.ca, www.amazon.fr, www.amazon.co.uk, www.amazon.de,and www.amazon.co.jp--and at Syndicated Stores domains, as well as Amazon.com-owned items sold at non-Amazon.com domains, such as books, music and DVD/video items ordered from Amazon.com's store at www.target.com. Units do not include Amazon.com gift certificates.

|